THE ANALYSIS OF THE COMPETITIVE ENVIRONMENT OF PJSC «TERA»

THE ANALYSIS OF THE COMPETITIVE ENVIRONMENT OF PJSC «TERA»

THE ANALYSIS OF THE COMPETITIVE ENVIRONMENT OF PJSC «TERA»

O. O. Vashkiv,

Student

O. P. Vashkiv,

Ph.D., Associate Professor Department of Entrepreneurship and Trade

Ternopil National Economic University, Ukraine, Ternopil

Today, the production of confectionery is one of the most developed sectors of the food industry in Ukraine. Confectionery market in Ukraine is highly competitive and saturated. It employs about 800 companies [3, p. 123]. Apart from that, the domestic market of confectionery is fairly consolidated. Much of confectionery products (60%) are produced and sold by about ten confectionery companies. The main participants in Ukrainian confectionery market are «Roshen», «Korona», «Svitoch», «Conti», «Lyubimov», «AVK» [1] and others. The largest share of the confectionery market in Ukraine is taken by the domestic products. In total, the sales they represent are about 95% [3, p. 123].

Confectionery industry employs about 170 thousand workers. The production capacity of the industry loaded about 70%. Total production capacity is over 400 thousand tons per year [2, p. 272], which allows not only to fully meet the needs of the domestic market but also export the products abroad.

During the last 8 years the market leader in confectionery is a corporation «Roshen», which in 2018 ranked seventh in the overall ranking of the top 100 brands and Ukraine confidently holds first place among brands confectionery industry. Dynamics of competing brands in confectionery industry of Ukraine for 2011-2018 are presented in Fig. 1.

The main struggle for the leading position in the ranking of the top 100 brands in the confectionery field of Ukraine carried out six such brands as «Roshen» «Korona», «Svitoch», «Conti», «AVK» and «Lyubimov». First place in this list surely hold «Roshen», «Korona» and «Svitoch». In a highly competitive market of confectionery creation of products under a particular brand is a prime example of the prevailing competitive advantage that is focused on the consumer. From this perspective, the brand as a competitive advantage of the enterprise allows consumers to identify products and create attractive image of it. From the point of view of the enterprise, the brand is its competitive advantage, which allows the formation of groups of regular consumers, and, therefore, becomes a precious asset of the enterprise.

The peculiarity of confectionery field of the market regarding the dynamics of change in their rating position is that some brands may fall out of the rankings, but coming back it does not lose the previous position. For example, Conti and AVK rankings in 2014 had 57 and 77 positions respectively and later in 2015 both companies never entered the top 100 brands in Ukraine. Having returned in 2016 without significantly changing its position, companies managed to rank 58 and 66 positions. Changes in domestic companies ranking positions within confectionery industry for the period of 2011-2018 are presented in Annex 8.

Today PJSC «Tera» continues to increase production and expanding the existing sales network as well as working to create the brand «Tera». The main priorities of the company are quality products, which is the main competitive advantage of the company.

The main markets of PJSC «Terra» are Ternopil region, Kyiv region and the Western Ukrainian region. The company cooperates with all categories of customers: stores, private entities, companies that sell products in the following cities: Lutsk, Khmelnytsky, Ivano-Frankivsk, Lviv, Vinnytsia, Mukachevo, Uzhgorod, Kyiv, Kalush, Rivne, Alexandria.

The main competitors of the company are TM «AVK» (m.Dnipro), TM «Rodyna» (Rivne region), «Stymyl» TM (Dnipro), TM «Roshen» (Kyiv), TM «Zagora» (Kyiv), TM «Svitoch» (Lviv), TM «Mriya» (Poltava region). TM «Lucas» (Kremenchug).

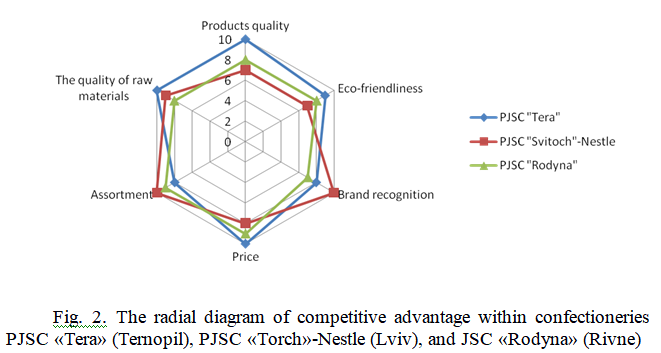

Each of these companies are certainly characterized by a number of competitive advantages that provide an adequate level of competitiveness in the confectionery market of Ukraine. By the use of radial diagrams we have illustrated the review of key competitive advantages within geographically closest competitors of PJSC «Tera» (Fig. 2).

As shown in the diagram, the high-quality products of PJSC «Tera», its cost, control of the raw materials used, and low emissions are what differentiates the company from the competitors. However, the company lags behind its rivals on indicators such as brand awareness and breadth of product range.

The confectionery products of PJSC «Tera» are made by modern technology. The operation of modern equipment, strict observance of technology and sales emphasis on using only high-quality raw materials, original recipes, which are used in the manufacture of confectionery products, environmental products – these are the main competitive advantages of the company «Tera» that has been in the market for 65 years.

2. Статистичний щорічник України за 2017 рік / за ред. І.Є. Вернера. Київ : Державна служба статистики України, 2018. 541 с.

3. Тичинська А. І., Наумова М. А. Дослідження ринку кондитерських виробів України. Вісник студентського наукового товариства ДонНУ імені Василя Стуса. 2017. С. 122-126.

Student

O. P. Vashkiv,

Ph.D., Associate Professor Department of Entrepreneurship and Trade

Ternopil National Economic University, Ukraine, Ternopil

Today, the production of confectionery is one of the most developed sectors of the food industry in Ukraine. Confectionery market in Ukraine is highly competitive and saturated. It employs about 800 companies [3, p. 123]. Apart from that, the domestic market of confectionery is fairly consolidated. Much of confectionery products (60%) are produced and sold by about ten confectionery companies. The main participants in Ukrainian confectionery market are «Roshen», «Korona», «Svitoch», «Conti», «Lyubimov», «AVK» [1] and others. The largest share of the confectionery market in Ukraine is taken by the domestic products. In total, the sales they represent are about 95% [3, p. 123].

Confectionery industry employs about 170 thousand workers. The production capacity of the industry loaded about 70%. Total production capacity is over 400 thousand tons per year [2, p. 272], which allows not only to fully meet the needs of the domestic market but also export the products abroad.

During the last 8 years the market leader in confectionery is a corporation «Roshen», which in 2018 ranked seventh in the overall ranking of the top 100 brands and Ukraine confidently holds first place among brands confectionery industry. Dynamics of competing brands in confectionery industry of Ukraine for 2011-2018 are presented in Fig. 1.

The main struggle for the leading position in the ranking of the top 100 brands in the confectionery field of Ukraine carried out six such brands as «Roshen» «Korona», «Svitoch», «Conti», «AVK» and «Lyubimov». First place in this list surely hold «Roshen», «Korona» and «Svitoch». In a highly competitive market of confectionery creation of products under a particular brand is a prime example of the prevailing competitive advantage that is focused on the consumer. From this perspective, the brand as a competitive advantage of the enterprise allows consumers to identify products and create attractive image of it. From the point of view of the enterprise, the brand is its competitive advantage, which allows the formation of groups of regular consumers, and, therefore, becomes a precious asset of the enterprise.

The peculiarity of confectionery field of the market regarding the dynamics of change in their rating position is that some brands may fall out of the rankings, but coming back it does not lose the previous position. For example, Conti and AVK rankings in 2014 had 57 and 77 positions respectively and later in 2015 both companies never entered the top 100 brands in Ukraine. Having returned in 2016 without significantly changing its position, companies managed to rank 58 and 66 positions. Changes in domestic companies ranking positions within confectionery industry for the period of 2011-2018 are presented in Annex 8.

Today PJSC «Tera» continues to increase production and expanding the existing sales network as well as working to create the brand «Tera». The main priorities of the company are quality products, which is the main competitive advantage of the company.

The main markets of PJSC «Terra» are Ternopil region, Kyiv region and the Western Ukrainian region. The company cooperates with all categories of customers: stores, private entities, companies that sell products in the following cities: Lutsk, Khmelnytsky, Ivano-Frankivsk, Lviv, Vinnytsia, Mukachevo, Uzhgorod, Kyiv, Kalush, Rivne, Alexandria.

The main competitors of the company are TM «AVK» (m.Dnipro), TM «Rodyna» (Rivne region), «Stymyl» TM (Dnipro), TM «Roshen» (Kyiv), TM «Zagora» (Kyiv), TM «Svitoch» (Lviv), TM «Mriya» (Poltava region). TM «Lucas» (Kremenchug).

Each of these companies are certainly characterized by a number of competitive advantages that provide an adequate level of competitiveness in the confectionery market of Ukraine. By the use of radial diagrams we have illustrated the review of key competitive advantages within geographically closest competitors of PJSC «Tera» (Fig. 2).

As shown in the diagram, the high-quality products of PJSC «Tera», its cost, control of the raw materials used, and low emissions are what differentiates the company from the competitors. However, the company lags behind its rivals on indicators such as brand awareness and breadth of product range.

The confectionery products of PJSC «Tera» are made by modern technology. The operation of modern equipment, strict observance of technology and sales emphasis on using only high-quality raw materials, original recipes, which are used in the manufacture of confectionery products, environmental products – these are the main competitive advantages of the company «Tera» that has been in the market for 65 years.

The list of used informational sources

1. Рейтинг національних брендів «UkrBrand-2018». URL: http://mppconsulting.com.ua/ukrbrand/ukrbrand2018.pdf (дата звернення: 20.02.2020 р.).2. Статистичний щорічник України за 2017 рік / за ред. І.Є. Вернера. Київ : Державна служба статистики України, 2018. 541 с.

3. Тичинська А. І., Наумова М. А. Дослідження ринку кондитерських виробів України. Вісник студентського наукового товариства ДонНУ імені Василя Стуса. 2017. С. 122-126.

Права доступу до цього форуму

Ви не можете відповідати на теми у цьому форумі